Bazan Group: A Bottleneck in the Oil Refining Sector of the Israel

Bazan Group, formerly known as Oil Refineries Ltd, is an oil refining and petrochemical company located in Haifa, Israel. This group operates the largest oil refinery in the regime. The company has a total refining capacity of approximately 9.8 million tons of crude oil annually, with a Nelson Complexity Index of 9 .

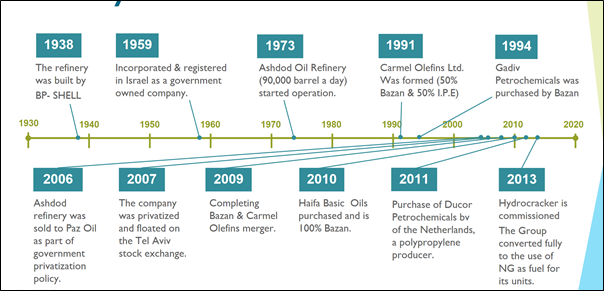

Timeline of the Company’s History

The group produces a maximum of about 26,600 tons of crude oil per day (approximately 197,000 barrels). Approximately 70% of its products are distributed in the Israeli market, while the remainder is sold in international markets, particularly in the Eastern Mediterranean. Crude oil refining constitutes about 85% of the company’s operations. Bazan Group is the largest refiner of crude oil in the Israeli regime and, consequently, the largest producer of kerosene, gasoline, and diesel fuel for transportation in the occupied territories.

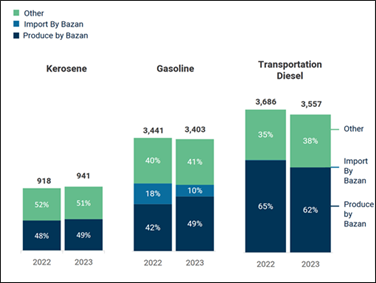

Fuel Consumption for Transportation in the Occupied Territories Kerosene, gasoline and diesel for transportation (Tons)

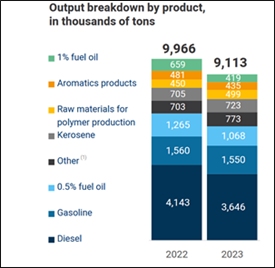

As shown, fuel consumption for transportation in 2023 has decreased by about 2% compared to the same period last year. This decline is primarily attributed to a nearly 18% drop in the fourth quarter of 2023 compared to the same period last year, influenced by the ongoing conflict. The following chart illustrates the breakdown of Bazan’s product production by product type in thousands of tons, which includes 1% fuel oil, aromatic products, raw materials for polymer production, kerosene, 0.5% fuel oil, gasoline, diesel, and other products such as LPG, asphalt, and occasionally naphtha.

Breakdown of Bazan’s Product Production by Product (Thousands of Tons)

Financial Details

The company’s revenue in 2022 was $441.22 million. This amount was $252.84 million in 2021, $274.32 million in 2020, $99.34 million in 2019, and $187.10 million in 2018.

Company Income Statement from 2018 to 2022 Including Revenue, Operating Income, Net Income, and EBITDA in Dollars

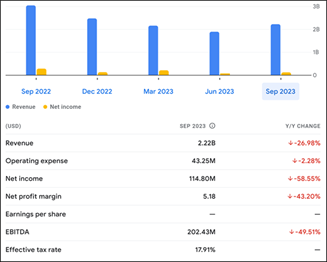

It has also been reported that the net income of the company in September 2023 was $114.80 million, reflecting a decrease of 58.5% compared to the previous year [1].

Company Income Statement from September 2022 to September 2023 Including Revenue, Operating Income, Net Income, and EBITDA in Dollars

Reports indicate that the company’s revenue and profitability in 2023 have declined compared to 2022, primarily due to falling oil prices, reduced sales in the refining sector, and lower margins in the polymer sector. As a result of decreased demand in the fourth quarter due to the ongoing Gaza conflict, the operational utilization rate at the company’s refining facilities dropped from about 97% in 2022 to around 87%.

The Gaza conflict has impacted Bazan’s operations in the fourth quarter of 2023. Demand for the company’s products has decreased since the start of the war, particularly in October, due to a slowdown in the Israeli economy alongside supply chain challenges, particularly in maritime transport and related infrastructure, which affected the performance of the company’s facilities. Additionally, Bazan incurred costs due to the postponement of scheduled maintenance, which was supposed to begin in October 2023, due to security conditions and an order from the Israeli regime to maintain operational continuity. The demand for the company’s refining products, especially for transportation, initially decreased with the outbreak of the war but returned to normal after a few weeks, except in the aviation sector, which has not yet resumed full operations. On the other hand, demand from the Ministry of Defense and Electric Corporation increased due to purchases of diesel fuel for emergency reserves

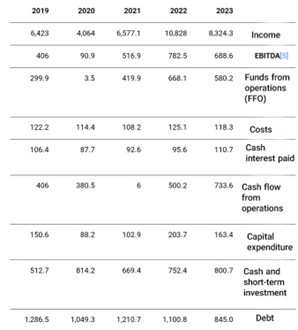

Financial Details for the Company from 2019 to 2023 in Shekel

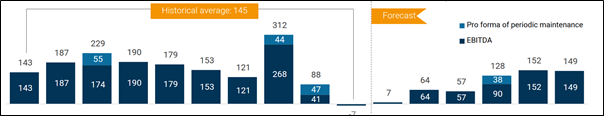

Bazan Group has a subsidiary named Carmel Olefins, which operates in the polymer sector. The following chart shows the company’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) for the past and forecasts the amount of this income in millions of US dollars in the company’s future.

Earnings Before Interest, Taxes, Depreciation, and Amortization for Carmel Olefins

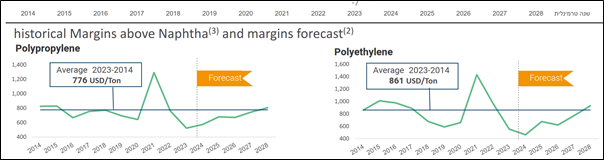

The following chart illustrates the production and revenue from naphtha, categorized by polypropylene and polyethylene, measured in dollars per ton for past years, along with future projections.

Production and Revenue from Naphtha by Polypropylene and Polyethylene in Dollars/Ton

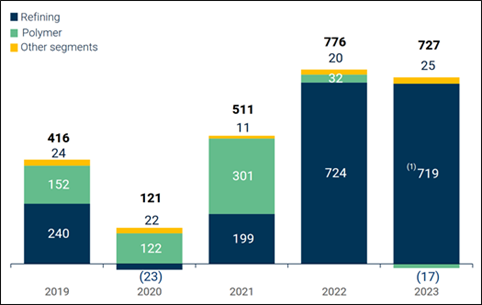

The following chart displays the volume of consolidated Earnings Before Interest, Taxes, Depreciation, and Amortization in millions of dollars based on the breakdown of polymer, refining, and other sectors. This chart also accounts for the approximate impact of the recent war, amounting to about $32 million in 2023 [3].

Volume of Consolidated Earnings Before Interest, Taxes, Depreciation, and Amortization in Millions of Dollars Based on Sector Breakdown

Conclusion

Any disruption to Bazan Group could severely impact the crude oil refining sector of the Israeli regime, subsequently affecting fuel supply for the transportation sector in the occupied territories, as well as its exports, and diminishing the regime’s foreign revenue. Pressure from public opinion, especially in the Islamic world, could lead to partners of Bazan in various countries, including the United Arab Emirates, Azerbaijan, and Turkey, to sever ties with the company.

#Bazan_Group

#Israel’s_Oil_Supply_Chain

Footnotes:

[1] Google Finance

[2] Bazan Group Investor Presentation

[3] Bazan Group Investor Presentation