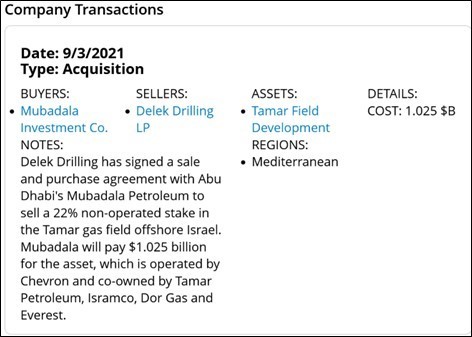

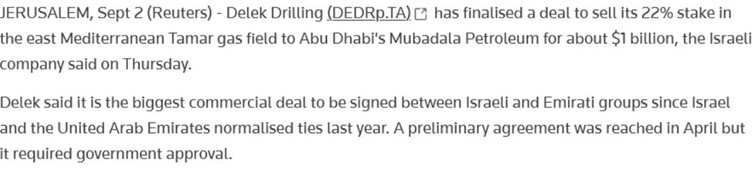

A study on companies from the Islamic world involved with this company revealed collaborations between UAE companies Mubadala and ADNOC with New Med Energy. In December 2021, Mubadala Petroleum acquired 22% of the shares in Delek Drilling LP for a value of $1.025 billion.

Share Purchase Details

Mubadala stated that the acquisition enhances its gas portfolio to support energy transition goals. This transaction represents the largest deal between Israel and the UAE since the normalization of relations in 2020.

News Regarding the Share Acquisition by the UAE Company

The Tamar field has been producing gas since 2013 and is located approximately 90 kilometers west of Haifa. Mubadala had previously signed a memorandum of understanding with Delek Drilling to purchase this offshore asset in April 2021[1].

Furthermore, Mubadala Investment Company, an Abu Dhabi-based sovereign fund, owns 11% of the Tamar field [2]. In 2023, it was reported that ADNOC and BP planned to jointly acquire a stake in Israeli company New Med Energy valued at $2 billion. Their target was to purchase 50% of the Israeli company’s shares—45% through the acquisition of the company’s free shares and 5% from Delek Group Ltd.

Yossi Abu, CEO of New Med, remarked in an interview:

“This offer is the result of a long-standing collaboration with BP and ADNOC, which will evolve into a more significant relationship. This partnership focuses on the Eastern Mediterranean—Israel, Cyprus, and Egypt.”

#Mubadala

#ADNOC

#UAE

#NewMed_Energy

Footnotes:

[1] Delek Drilling sells 22 percent stake in Tamar field to Mubadala Petroleum

[2] ADNOC, bp form natural gas partnership to purchase Israeli energy company for $2 billion